Investors are drawn to purchasing options for a variety of reasons.

In the world of stocks and options, the highest returns are seen through ownership of either Call or Put options.

This is due to the fact that purchasing options carries both high risk and high potential for reward.

Investors who purchase Call Options tend to see the highest returns when the stock experiences an increase in value.

The greatest profits for Put Option buyers come from a decrease in stock value.

OptionsPop.com employs a single, straightforward approach –

Underlying Securities

Invest in stocks and sell them within a short time frame of 2 to 9 days.

The Buyer’s Advantage for Options…

The potential to exert influence

Options are favored by traders seeking a substantial return in exchange for a minimal investment.

For instance…

Suppose you noticed that Tesla (stock ticker symbol TSLA) presented an excellent trading opportunity due to its potential for a substantial upward movement. As a result, you purchased 100 shares of the stock.

Purchasing 100 shares of TSLA at the current trading price of $120 per share would require an investment of $12,000.

Imagine if, immediately following your purchase of TSLA, the stock price shoots up by $13.00 per share.

After the stock price increased by thirteen dollars per share, you earned a total profit of $13.00 on your 100 shares, resulting in a gain of 10.8%.

To begin again, imagine if you were interested in utilizing options for TSLA instead. An “option” grants the ability… without any requirement… to purchase the company’s stock.

Suppose you purchase a Call option on TSLA at a price of $2.25. Since each contract represents 100 stocks, the total cost for one contract would be $225.00.

In the same scenario, as the value of TSLA shares rose by $13 in a single day…the associated Call options for TSLA increased from $2.25 to $15.50. This results in a 588% profit, as opposed to a mere 10.8%.

In just a day, a single trade yielded a whopping 588% return!

“Oh, so that’s a potential pop for you.”

Leverage is a powerful tool, and it’s the top reason why countless traders favor options over stocks.

The Disadvantages To Buying Options…

When purchasing an option, the main concern is that the underlying stock does not move in your favor or moves against it, resulting in a decrease in the value of the purchased option.

Purchasing an option and if the stock remains within a narrow price range until the option’s expiration, it will result in the option expiring without value.

Hence, the stock underlying your option purchase must shift in your favor within 2 to 10 days; otherwise, the price of the option may decrease, possibly reaching zero.

What is the risk?

That’s an excellent question and the direct response is that you put all of the money you use for the trade at risk.

These trades can carry significant risk.

Ensure that you are only engaging in transactions with funds that you are able to part with without significant impact on your financial stability.

It’s important to understand this from the beginning: your maximum loss is determined by the amount you invest in the trade, but you have the ability to minimize that potential loss by utilizing a stop loss order.

Our objective is to identify stocks with a strong likelihood of either increasing or decreasing within a period of 2 to 9 days, and informing you of the most suitable choices for that particular stock.

Here’s How OptionsPop.com Works…

At OptionsPop.com, we utilize technical analysis to identify stocks with a strong chance of experiencing movement within a timeframe of 2 to 9 days.

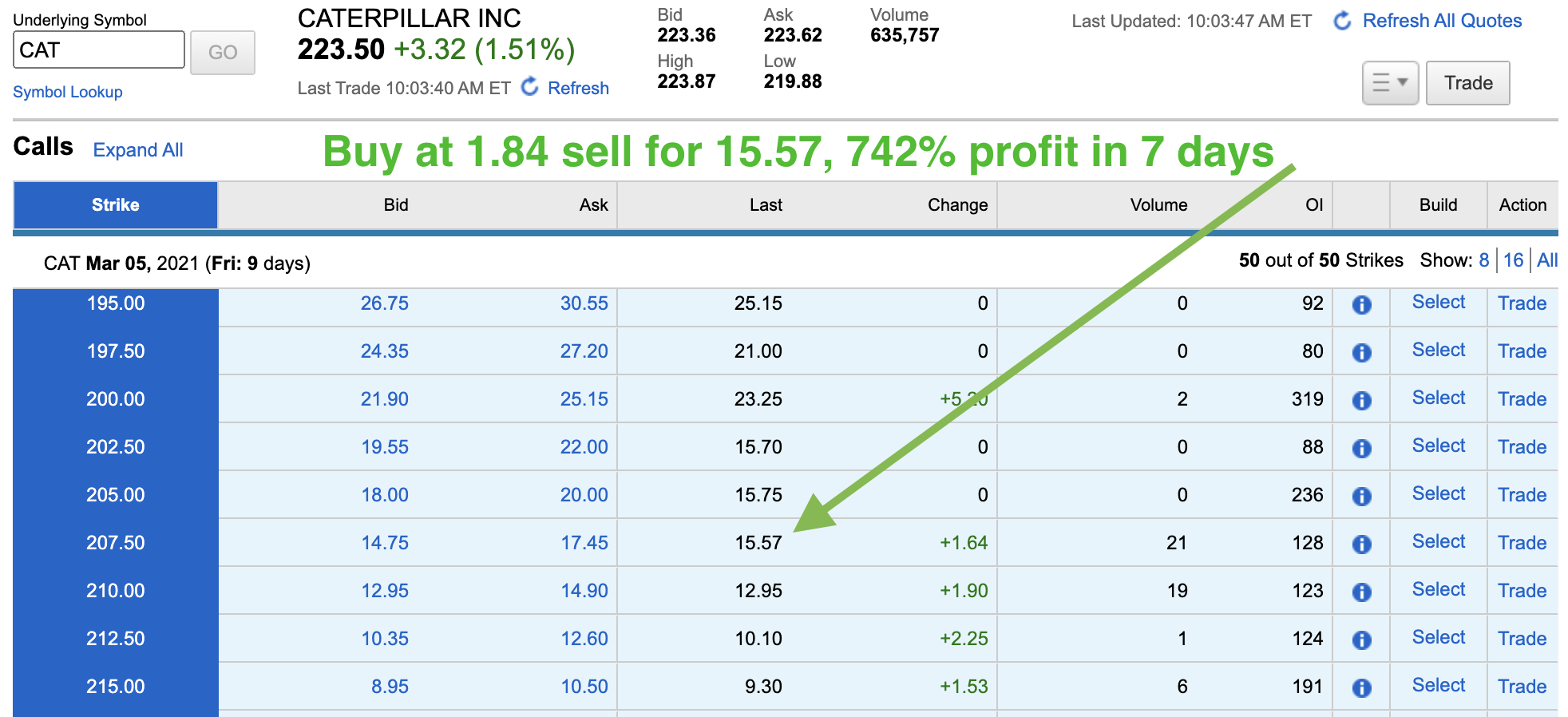

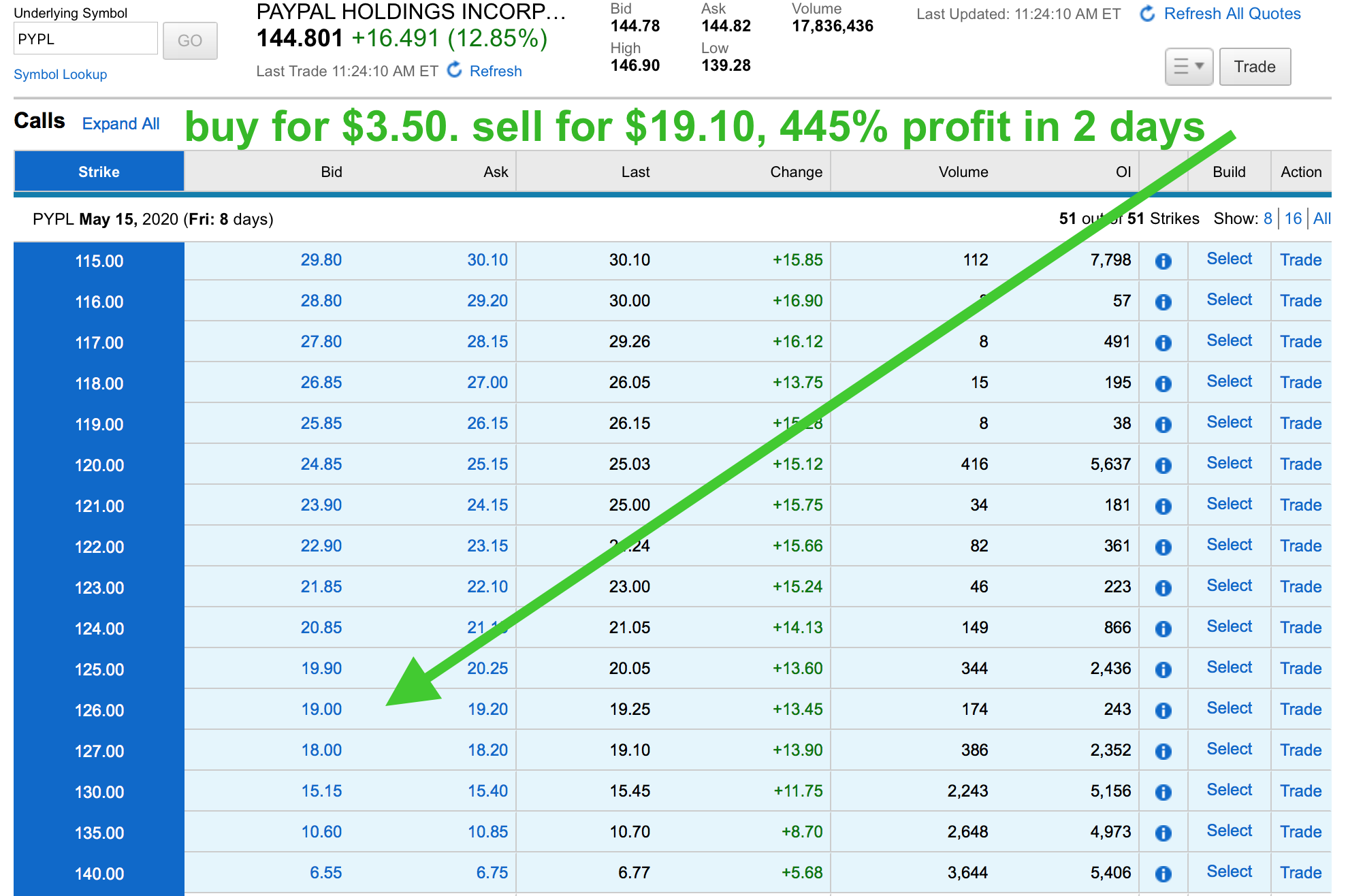

After identifying a stock, the program selects the appropriate Call or Put options and corresponding strike prices that are likely to increase in value.

Receive a weekly notification containing the top Call or Put Options to purchase, complete with stock symbol, recommended options and strike prices, and corresponding purchase price.

After sending an options Buy alert through text and email to our subscribers, we also make the trade available in the private Member’s Only section on our website.

This method…

of being profitable.

Within the next 9 days or less, it is expected that there will be an increase in price.

OptionsPop.com takes care of all the difficult tasks for you!

Detects Potential Market Movement in Put or Call Options

Sends a purchase notification to members via email.

New posts have been added to the member’s area.

Gain access to complementary training for Options Trading.

Here’s Everything You Get As An OptionsPop.com Subscriber…

Get immediate and limitless entry to the member’s section.

Receive three (3) pop email alerts per week with purchase options.

A comprehensive trader training program consisting of ten (10) modules for options trading.

Latest News from New Options Training

Our email support team is available to assist with any inquiries or concerns you may have. Our dedicated support staff is always ready to respond promptly and provide you with the best possible solutions. Don’t hesitate to reach out to us via email for any help you need.

Exclusive “Members’ Only” Perk

Our 30-day refund policy ensures that you can make your purchase with confidence, knowing that if you are not completely satisfied, we will provide a full refund.

By subscribing, members receive 3 weekly options picks and trader training to optimize their trades.

You will receive the precise stock option, along with its strike prices, expiration date, and purchasing cost.

You will be notified of these alerts via email, text message, and in the Member’s area of the website.